pay indiana state estimated taxes online

Indiana State Tax Quick Facts. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

.png)

Quarterly Tax Calculator Calculate Estimated Taxes

An INTIME Functionality chart listed by tax type is available.

. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable. Take the renters deduction.

Pay online quickly and easily using your checking or savings account bankACHno fees or your debitcredit card fees apply through INTIME DORs e-services portal. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form. You do not need to create an INTIME logon to.

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is filed. You will receive a confirmation number immediately after paying. Ad No Money To Pay IRS Back Tax.

The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding corporate income tax and individual income tax in one convenient location 247. Vehicle use tax bills RUT series tax forms must be paid by check. Ad Find Pay Indiana Income Tax.

Indiana Income Tax Calculator 2021. You can also pay your estimated tax payments using the IRS2Go app. Your average tax rate is 1198 and your marginal tax rate is 22.

Have more time to file my taxes and I think I will owe the Department. If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. We last updated the Estimated Tax Payment Voucher in January 2022 so this is the latest.

If you did make estimated tax payments either they were not paid on time or you did not pay. To make an estimated tax payment online log on to DORs e-services portal the Indiana Taxpayer Information Management Engine INTIME at intimedoringov. How do I pay estimated taxes for 2020.

Corporations generally have to make estimated tax payments if they expect to owe tax of 500 or more when their. 32 cents per gallon of regular gasoline and 53 cents per gallon of diesel. If the amount on line I also includes estimated county tax enter the portion on lines 2 andor 3 at the top of the form.

DOR offers customers several payment options including payment plans for liabilities over 100. To make an individual estimated tax payment electronically without logging in to INTIME. Pay my tax bill in installments.

Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form. Estimated payments may also be made online through Indianas INTIME website. Select the Make a Payment link under the Payments tile.

You can send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or via your mobile device using the IRS2Go app. Indianas statewide income tax has decreased twice in recent years. Claim a gambling loss on my Indiana return.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Tax Payment Solution TPS - Register for EFT payments and pay EFT Debits online. The tax bill is a penalty for not making proper estimated tax payments.

Find Indiana tax forms. Session Expiration Logout Now Continue Working. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Access INTIME at intimedoringov. Your browser appears to have cookies disabled. If you have an MyTax Illinois account click here and log in.

081 average effective rate. If you dont already have a MyTax Illinois account click here. Who Must Pay Estimated Tax.

To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. 323 statewide flat rate counties may charge additional rates Sales tax.

Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. Only break out your spouses estimated county tax if your spouse owes tax to a county other than yours. Here are your payment options.

Cookies are required to use this site. Check or money order follow the payment instructions on the form or voucher associated. Estimated Indiana income tax due enter the amount from line I on line 1 State Tax Due at the top of the form.

Know when I will receive my tax refund. DORpay is no longer available to pay Indiana tax liabilities as this service has moved to INTIME DORs new e-service portal at intimedoringov. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if not enough tax was withheld you need to be making estimated tax payments.

For a complete list of payment alternatives go to IRSgovpayments. If filing a paper return with payment make the check or money order payable to Kentucky State Treasurer and mail to. Follow the links to select Payment type enter your information and make your payment.

Indiana has a flat state income tax rate of 323 for.

Indiana State Tax Information Support

E File Indiana Taxes Get A Fast Refund E File Com

Dor Owe State Taxes Here Are Your Payment Options

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Dor Indiana Extends The Individual Filing And Payment Deadline

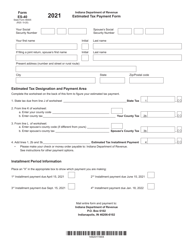

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Individual Income Tax Payers Added To Indiana Online Tax Portal Intime

Indiana Dept Of Revenue Inrevenue Twitter

Estimated Income Tax Payments For 2023 And 2024 Pay Online

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

2021 Instructions For Schedule H 2021 Internal Revenue Service

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

![]()

Free Indiana Payroll Calculator 2022 In Tax Rates Onpay

Dor Owe State Taxes Here Are Your Payment Options

Dor Keep An Eye Out For Estimated Tax Payments

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller

Form Es 40 State Form 46005 Download Fillable Pdf Or Fill Online Estimated Tax Payment Form 2021 Indiana Templateroller